Offshore Trusts for Business Owners: A Hidden Asset Protection Tool

Exactly How an Offshore Count On Can Enhance Your Financial Personal Privacy and Protection

If you're looking to boost your financial personal privacy and safety, an overseas count on could be a practical option. By tactically placing your possessions outside local territories, you can protect on your own from possible legal dangers and analysis.

Recognizing Offshore Trusts: The Basics

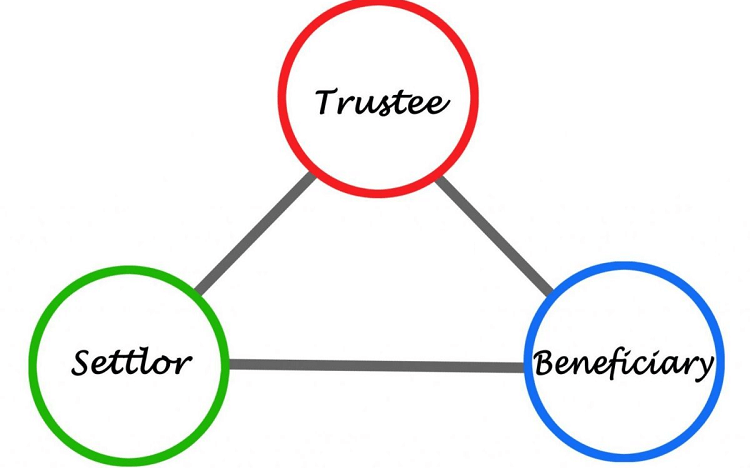

Offshore counts on are powerful monetary devices that can give you with enhanced privacy and security for your possessions. Basically, an offshore count on is a legal plan where you transfer ownership of your possessions to a trustee located outside your home nation. This trustee manages the assets in your place, allowing you to maintain control while delighting in the benefits of offshore financial systems.

You can use offshore depends on to guard your wealth from potential lawful issues, tax obligations, or political instability in your house country. By positioning your possessions in an overseas count on, you create an obstacle in between your wide range and any claims against you, enhancing your financial safety.

Comprehending the fundamentals of offshore trust funds is essential for any individual considering this method. You'll need to select a trustworthy trustee and browse the lawful demands of the jurisdiction where the trust is developed, ensuring your possessions are shielded efficiently.

Trick Benefits of Offshore Trusts

2nd, offshore counts on offer diversification. You can invest in numerous money, markets, and asset courses, reducing danger and boosting potential returns.

Furthermore, they can supply tax obligation benefits. Depending upon the territory, you might appreciate tax advantages that boost your overall monetary approach.

Moreover, offshore trusts enable raised control over your wealth. You can set certain terms for how and when your assets are dispersed, ensuring your purposes are recognized.

Finally, they can assist with estate planning. An offshore count on can streamline the transfer of wealth across generations, lessening prospective disagreements. On the whole, these key advantages make offshore trusts an enticing alternative for economic security.

Enhancing Financial Privacy With Offshore Trust Funds

When you take into consideration offshore trust funds, assume regarding how they can considerably improve your financial privacy. These trusts use robust possession security techniques while guaranteeing confidentiality and privacy in your monetary negotiations. By utilizing them, you can safeguard your wide range from possible dangers and maintain your personal privacy in an increasingly transparent world.

Possession Security Techniques

Establishing an overseas trust fund can be an effective strategy for improving economic privacy and protection, especially if you're seeking to secure your properties from potential creditors or lawful cases. By moving your possessions right into an offshore trust fund, you efficiently divide your personal wide range from your legal identity. This splitting up can deter financial institutions, as they may discover it testing to gain access to assets held in a depend on. Additionally, you can choose the territory that supplies the strongest possession defense laws, additionally protecting your financial investments. Regularly assessing and changing your trust can ensure it continues to be aligned with your economic goals, offering enduring security. Ultimately, offshore depends on can be an aggressive action for anybody looking for to strengthen their financial future.

Discretion and Privacy

Offshore depends on not only provide robust property defense yet likewise play a substantial role in boosting your financial personal privacy. By placing your assets in an overseas count on, you can effectively protect your monetary info from prying eyes. Many territories give stringent privacy laws that safeguard the identities of trust fund recipients and grantors. This implies you can maintain a degree of anonymity that's tough to accomplish with residential trusts (Offshore Trusts). In enhancement, the trust framework can restrict accessibility to your monetary details, ensuring that just licensed people have understanding into your properties. This enhanced discretion enables you to handle your riches without the constant analysis that usually includes onshore holdings, giving you tranquility of mind in your monetary affairs.

Safeguarding Assets From Lawful Risks

When it concerns guarding your wealth, offshore depends on use a robust legal guard versus possible dangers. They provide a level of confidentiality and privacy that can be vital in protecting your properties. By using efficient property protection techniques, you can protect your financial future from legal difficulties.

Legal Guard Benefits

While numerous individuals seek financial navigate to these guys personal privacy, the lawful guard benefits of offshore counts on can offer a crucial layer of defense against possible legal dangers. By putting your properties in an overseas trust fund, you can develop an obstacle that makes it a lot more tough for creditors or litigants to reach your wide range.

Discretion and Privacy

Exactly how can you assure your economic affairs stay private in today's significantly transparent world? An offshore depend on can give the confidentiality you look for. By positioning your properties in this trust fund, you produce a legal barrier between your personal identification and your wealth, effectively shielding them from spying eyes. The count on operates under the legislations of a jurisdiction recognized for rigorous privacy guidelines, making it tough for outsiders to access your info.

Furthermore, your participation as a trustee can remain concealed, guaranteeing your name isn't directly linked to the properties. This privacy can deter prospective lawful hazards, as people and entities might believe twice before targeting someone whose economic details are covered. Protecting your personal privacy has actually never been more essential, and an overseas count on is an effective tool.

Asset Protection Strategies

An overseas trust not just improves your monetary privacy but likewise acts as a robust asset security technique against legal risks. By positioning your assets in a trust fund located in a jurisdiction with solid privacy regulations, you can secure them from lenders and legal actions. This indicates that if you deal with lawful action, the properties held in the trust fund are commonly past the reach of regional courts. In addition, you can designate recipients, ensuring that your riches is given according to your wishes. Regularly assessing and updating your count on framework can better enhance your security. In today's litigious atmosphere, using an overseas trust can be a smart relocate to secure your economic future and keep control over your assets.

Political and Economic Security: A Factor To Consider

When thinking about overseas counts on, political and financial stability in the chosen territory plays an essential role in safeguarding your assets. You want browse around here to assure that the setting where your depend on is developed remains safe and secure and trusted. Political chaos or financial instability can threaten your investments and jeopardize your monetary privacy.

Search for jurisdictions with constant administration, a strong lawful framework, and a history of economic durability. These elements add to the count on's long life and your comfort.

Additionally, you ought to examine the nation's regulative setting. Positive guidelines can improve your count on's performance, while restrictive regulations might prevent its effectiveness.

Eventually, by focusing on political and economic security, you're not simply securing your properties; you're additionally leading the way for long-term monetary safety. Your cautious choice will assist guarantee that your depend on continues to be a powerful tool in your monetary approach, permitting you to achieve your goals with self-confidence.

Picking the Right Jurisdiction for Your Offshore Depend On

Which aspects should lead your selection of jurisdiction for an offshore depend on? Look for territories with solid possession security regulations to safeguard your trust from possible financial institutions.

You ought to likewise consider the regulatory atmosphere. A respectable territory with clear regulations can boost your trust's credibility and stability. Access to expert solutions is another necessary factor; make specific that the territory has proficient lawful and economists who can help you effectively.

Finally, visit this site right here analyze the privacy laws. You want a location that prioritizes your personal privacy and safeguards your info. By evaluating these elements, you'll be better equipped to choose a territory that straightens with your monetary goals and enhances your safety and personal privacy.

Steps to Establishing an Offshore Depend On

Picking the ideal jurisdiction is just the start of your trip to establishing an overseas count on. Next, talk to a certified lawyer that specializes in overseas depends on. They'll guide you through the lawful needs and guarantee conformity with both regional and international regulations.

After that, recognize the properties you intend to position in the count on. This can consist of cash, property, or financial investments - Offshore Trusts. Once you have actually established this, pick a trustee, a person you rely on or a professional depend on firm, to manage your trust fund according to your dreams

Fund the trust fund by transferring your picked properties. With these steps, you'll be on your means to taking pleasure in improved monetary personal privacy and protection via your overseas depend on.

Often Asked Questions

Can I Establish an Offshore Count On From Another Location?

Yes, you can establish an offshore trust fund remotely. Numerous territories enable on the internet applications and appointments. Just ensure you study reliable firms and understand the lawful requirements to make the process smooth and safeguard.

What Are the Tax Ramifications of Offshore Trusts?

Offshore trust funds can have different tax obligation ramifications relying on your residency and the trust fund's framework. You might encounter taxes on earnings generated, but proper planning can assist reduce responsibilities and make best use of benefits. Always get in touch with a tax expert.

How Are Offshore Trusts Controlled Internationally?

Can I Modification the Trustee of My Offshore Depend On?

Yes, you can change the trustee of your overseas depend on, but it normally calls for complying with details treatments described in the depend on record. Make certain you comprehend any type of legal effects prior to making that decision.

What Takes place if I Move to An Additional Country?

If you move to one more nation, your overseas trust fund's tax implications might transform. You'll need to assess neighborhood legislations and possibly consult with an expert to ensure conformity and optimize your monetary approach effectively.